Key Takeaways From The New Foreign-Sourced Income Exemption (FSIE) Regime In Hong Kong

This article first appeared in the March 2023 issue of the Hong Kong Lawyer, the official journal of The Law Society of Hong Kong.

Introduction

Hong Kong has introduced a new tax regime for foreign-sourced dividend, interest, intellectual property income and disposal gain in relation to shares or equity interests received in Hong Kong under the amended Inland Revenue Ordinance (Cap. 112) (IRO), which has come into effect on 1 January 2023.

Known as the foreign-sourced income exemption (FSIE) regime, it seeks to tackle tax avoidance arising from double non-taxation and fulfil the commitment made by Hong Kong to the European Union (EU) when Hong Kong was listed in an EU watchlist as one of the jurisdictions with harmful tax regimes in 2021.

The new regime target entities that are part of a multinational group (MNE entities) which receive foreign-sourced income in Hong Kong but have little economic substance in Hong Kong.

This article seeks to highlight the salient features of the new FSIE regime in Hong Kong.

|

Key takeaways

|

Background

Governments and international bodies have in recent years worked together to combat tax avoidance and evasion. It has become widely accepted international tax standards that taxpayers ought to demonstrate a substantial economic presence in a jurisdiction and to establish an explicit link between the relevant income and real activities in the jurisdiction before they can enjoy any preferential tax treatment in the jurisdiction.

Numerous jurisdictions have implemented legislative initiatives to avoid the stigma of being designated as a tax haven or targeted by countermeasures. For instance, popular offshore jurisdictions such as the British Virgin Islands and the Cayman Islands have introduced economic substance requirements back in 2019.

In October 2021, due to a lack of economic substance requirements and anti-abuse rules, Hong Kong was added to the EU list of non-cooperative jurisdictions for tax purpose and listed as one of the jurisdictions having harmful tax regimes that, according to the EU, do not conform with international tax standards. In consequence, Hong Kong pledged to the EU to amend its foreign-sourced income exemption regime by 31 December 2022.

In December 2022, Hong Kong government enacted the Inland Revenue (Amendment) (Taxation on Specified Foreign-sourced Income) Ordinance 2022, which introduced the FSIE regime under the IRO.

Preventing double non-taxation

Hong Kong adopts a territorial source principle of taxation. Profits tax is only chargeable where a person carries on a trade, profession or business in Hong Kong, and the profit arises in or is derived from Hong Kong.

In the past, offshore passive income received by multinational companies with no substantial economic presence in Hong Kong were not subject to Hong Kong profits tax. These companies may even be able to enjoy “double non-taxation”, meaning that their profits earned were non-taxable under both the laws of Hong Kong and the jurisdiction from which the profits were derived.

Following the introduction of the new FSIE regime, MNE entities will no longer be able to enjoy double non-taxation in respect of specified foreign-sourced income. Individuals and local companies that do not belong to a multinational group are not subject to the FSIE regime. This is because MNE entities can take advantage of the differences in tax systems of different jurisdictions and can easily shift their activities to low-tax jurisdictions to avoid taxation, whereas individuals and standalone local companies are less able to do so.

Deeming provision

Section 15I of IRO contains a deeming provision to impose profits tax on specified foreign-sourced income if:

- the income is received in Hong Kong by an MNE entity regardless of its revenue or asset size; and

- the recipient of income is unable to meet one of the three exceptions, namely, the economic substance requirement, the nexus requirement, and the participation requirement.

Specified foreign-sourced income encompasses four types of foreign-sourced income, namely: interest, dividend, disposal gain and intellectual property (IP) income.

Foreign-sourced incomes that do not fall within the meaning of specified foreign-sourced income are not currently covered by the new FSIE regime.

Exceptions

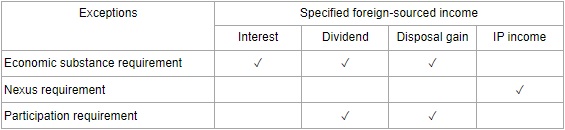

There are three exceptions for different types of income:

- economic substance requirement (for foreign-sourced interest, dividend or disposal gain);

- nexus requirement (for foreign-sourced IP income); or

- participation requirement (for foreign-sourced dividend or disposal gain).

Exception requirements

We highlight the key features of economic substance requirement and participation requirement below, which would apply to foreign-sourced interest, dividend and disposal gain (as the case may be) and which equity-holding MNE entities may rely on to avoid the effects of the deeming provision under IRO.

Economic substance requirement

An MNE entity may continue to enjoy the exemption from profits tax in respect of foreign-sourced interest, dividends and disposal gains received in Hong Kong if it fulfils the economic substance requirement, but the exact requirements depend on whether or not the MNE entity is a pure equity-holding entity, which is defined as an entity that only holds equity interests in other entities and only earns dividends, disposal gains and income incidental to the acquisition, holding or sale of such equity interests.

A pure equity-holding entity is required to: (i) comply with all the applicable registration and filing requirements under the Companies (Winding Up and Miscellaneous Provisions) Ordinance (Cap. 32), Limited Partnerships Ordinance (Cap. 37), Business Registration Ordinance (Cap. 310) and Companies Ordinance (Cap. 622); and (ii) have adequate human resources and premises for carrying out holding and managing its equity participations in other entities in Hong Kong.

Non-pure equity-holding entities are required to (i) employ an adequate number of qualified employees to carry out the specified economic activities – namely, making necessary strategic decisions and managing and bearing principal risks in respect of any assets the entity acquires, holds or disposes - in Hong Kong; and (ii) incurring an adequate amount of operating expenditures in carrying out such specified economic activities in Hong Kong.

Non-pure equity-holding entities have to demonstrate more substantial economic substance than pure equity-holding entities. Both are subject to adequacy tests.

The economic substance requirements allow an MNE entity to outsource some or all of its specified economic activities to third parties or group entities as long as the MNE entity demonstrates adequate monitoring and control of the relevant activities carried out by the outsourced entity and fulfils other outsourcing requirements.

Adequacy tests

Both limbs of the economic substance requirement are subject to adequacy tests. Since MNE entities differ vastly in size and modes of operation from industry to industry, there is no “one-size-fits-all” threshold for determining whether the adequacy tests are satisfied for the purpose of economic substance requirement.

It falls within the discretion of the Commissioner of Inland Revenue to decide on a case-by-case basis whether an MNE entity meets the adequacy requirements.

The Inland Revenue Department indicates that the following factors will be taken into account:

- the average number of employees in regard to the nature and level of the specified economic activities;

- whether the employees are employed on a full-time or part-time basis;

- the relevance of the employees’ qualifications to the nature of the specified economic activities;

- the quantitative and qualitative aspects of the management and administration of the MNE entity; and

- whether adequate office premises have been used for carrying out the specified economic activities.

Despite the above, the lack of clear guideline makes it unclear on how to comply with the economic substance requirement. For the sake of tax certainty and to ensure compliance, MNE entities are encouraged to apply to the Commissioner for advance rulings on their compliance in this regard.

Participation requirement

The participation requirement offers an alternative to the economic substance requirement to enable MNE entities which receive foreign-sourced dividend or disposal gain in Hong Kong to claim profits tax exemption.

The participation requirement is as follows:

- the MNE entity is a Hong Kong tax resident, or where it is a non-Hong Kong tax resident, it has a permanent establishment in Hong Kong to which the foreign-sourced dividend or disposal gain is attributable; and

- the MNE entity has continuously held not less than 5% of equity interests in the investee entity concerned for a period of not less than 12 months immediately before the foreign-sourced dividend or disposal gain accrues.

Therefore, an MNE entity that is a parent or intermediate holding company for more than 12 months may satisfy the participation requirement if it is a Hong Kong tax resident or has a permanent establishment in Hong Kong.

However, there are certain anti-abuse rules in place to disallow the participation exemptions, namely: “subject to tax” condition, anti-hybrid mismatch rule and main purpose rule. Please refer to section 15N of IRO and the guidance published by the Inland Revenue Department for details.

Nexus requirement

For the sake of completeness, the nexus requirement applies only to foreign-sourced IP income and is used to determine the extent of such income to be exempt from profits tax. The nexus requirement provides that only income from a qualifying IP asset can qualify for preferential tax treatment based on a nexus ratio (which is defined as the qualifying expenditures as a proportion of the overall expenditures that have been incurred by a taxpayer to develop an IP asset).

Please refer to Schedule 17FC of IRO and the guidance published by the Inland Revenue Department for details of the nexus requirement.

Further refinement to FSIE regime in relation to foreign-sourced capital gains

The Hong Kong government recently indicated that it will continue to refine the FSIE regime in light of the EU’s recent update to its guidance on foreign-sourced income exemption regimes such that, under the to-be-formulated regime, foreign-sourced capital gains in relation to assets, regardless of their financial or non-financial nature, received by MNE entities in Hong Kong will remain exempt from tax provided that the economic substance requirement is complied with.

The administration has also reiterated that Hong Kong will maintain the territorial source principle of taxation, and due regard will be given to Hong Kong’s tax competitiveness and minimisation of compliance burden.

Conclusion

Now that Hong Kong has put the FSIE regime in place to tackle tax avoidance, it is time for multinational group to prepare and brace themselves for this new regime. Fellow practitioners may wish to take note of the new regime when structuring a transaction or advising on matter that involve cross-border elements.

Who are affected by the FSIE regime?

The FSIE regime only affects MNE entities which receive specified foreign-sourced income. Individuals and local companies that are not part of a multinational group are not affected.

What are covered by the FSIE regime?

The FSIE regime will bring specified foreign-sourced income that is received by MNE entities, namely interest, dividend, disposal gain and IP income, into the taxable income.

What are the implications for individuals and local companies in Hong Kong?

Individuals and local companies that are not part of a multinational group are not affected.

What are the implications for MNE entities in Hong Kong?

The new regime will create additional reporting obligations and increase compliance costs.

MNE entities in Hong Kong are recommended to perform a self-assessment to determine if they receive any specified foreign-sourced income in Hong Kong and, if so, whether they satisfy the applicable exception requirements under the new regime.

MNE entities which receives specified foreign-sourced income may wish to take actions to satisfy the economic substance requirement, participation requirement and/or nexus requirement, as the case may be, in order to minimise their tax burden. For instance, shell companies may consider building up economic substance or outsourcing the specified economic activities.

Will this affect Hong Kong’s existing tax regime?

The FSIE regime will not override the territorial source principle and is not intended to alter Hong Kong’s low-tax regime.

Key takeaways

- New regime only applies to MNE entities.

- Individuals and standalone local companies are not affected.

- Hong Kong continues to adopt the territorial source principle of taxation.

- New FSIE regime is not intended to change the low-tax regime in Hong Kong.

- Specified foreign-sourced income will be deemed to be sourced from Hong Kong and taxable if the income is received in Hong Kong by an MNE entity and the recipient fails to meet one of the applicable exceptions.

- There are three exceptions for different types of income:

- economic substance requirement (for foreign-sourced interest, dividend or disposal gain);

- nexus requirement (for foreign-sourced IP income); or

- participation requirement (for foreign-sourced dividend or disposal gain).

Pan Tsang and Juno Guo

Disclaimer: This publication is general in nature and is not intended to constitute legal advice. You should seek professional advice before taking any action in relation to the matters dealt with in this publication.